Quick Take

The Accumulation Trend Score, a unique metric that unveils the relative behavior of various wallet cohorts, has spotlighted a striking divergence in the current Bitcoin landscape. The personalized score, calculated based on the size of the entities and their coin acquisitions over the past 15 days, has unveiled a distinct pattern among Bitcoin ‘whales.’

Yet, it’s crucial to consider that this data does not incorporate exchanges and miners, further emphasizing the need for comprehensive insights approaching the year-end.

These entities, with balances surpassing 10,000 BTC, have been in their most significant distribution phase since this year’s October, a stark contrast to their sustained accumulation trend that prevailed since mid-October.

Concurrently, the remaining cohorts, each with 10,000 BTC or less, maintain a robust accumulation trend, which was initiated around the same period. This divergence illustrates an intriguing shift in wallet behavior, potentially suggesting a reassessment of market conditions among larger entities.

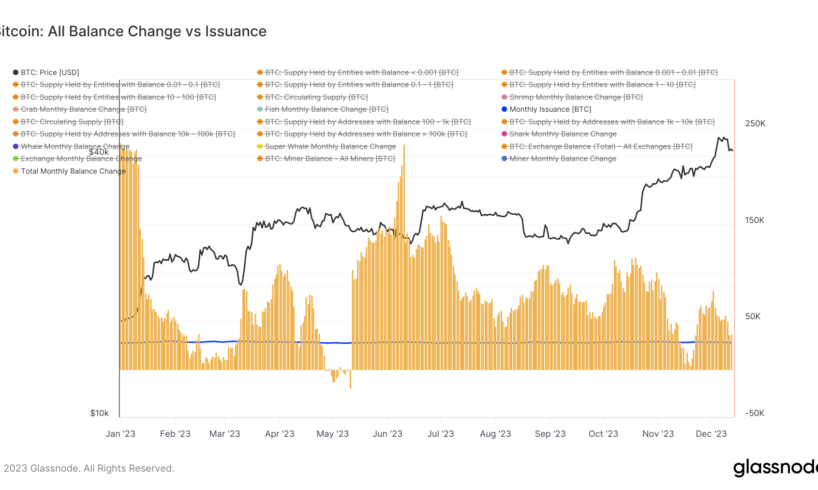

Upon examining all Bitcoin wallet cohorts, it’s evident that their current accumulation rate slightly surpasses Bitcoin’s monthly issuance. The monthly issuance of Bitcoin stands at approximately 27,500 BTC. Meanwhile, the cohort’s accumulation is estimated at around 36,000 Bitcoin, indicating a net positive accumulation over the coin’s issuance. This trend highlights a greater demand than supply in the current market, potentially contributing to a slightly bullish sentiment, but it is diminishing.

All Cohorts vs Issuance: (Source: Glassnode)

The post Bitcoin whales diverge from smaller holders amid year-end accumulation trend appeared first on CryptoSlate.