Onchain Highlights

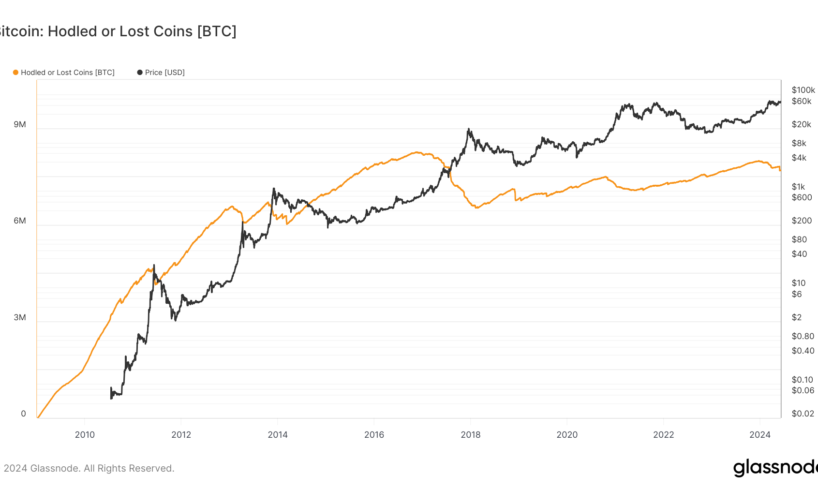

DEFINITION: Lost or HODLed Bitcoins indicate moves of large and old stashes. They are calculated by subtracting Liveliness from 1 and multiplying the result by the circulating supply.

Bitcoin’s “Hodled or Lost Coins” metric, as tracked by Glassnode, has reached notable levels, reflecting long-term trends in investor behavior. Glassnode estimates approximately 7.7 million BTC are either hodled or lost, significantly impacting the circulating supply and market forces.

Bitcoin: Hodled or Lost Coins: (Source: Glassnode)

In recent months, the metric has shown a decrease in hodled or lost coins, particularly in 2024. This shift suggests a possible reallocation of Bitcoin holdings as investors respond to market conditions post-halving. The last significant decline was in May, coinciding with Mt. Gox moving Bitcoin to a new wallet. Since January, there has also been a gradual decline, correlating with selling pressure from Grayscale, which held Bitcoin that may have been considered ‘hodled.’

Glassnode’s data highlights that periods of increased hodling typically correlate with reduced sell pressure, potentially leading to bullish price action. For example, during previous bear markets, increased hodling often preceded significant price recoveries.

Bitcoin: Hodled or Lost Coins: (Source: Glassnode)

Per CryptoSlate’s analysis, the current trend may reflect strategic decisions by long-term holders to retain or consolidate their positions in anticipation of future market movements (CryptoSlate). This behavior emphasizes the importance of monitoring on-chain metrics to understand broader market sentiments and investor strategies.