Ad

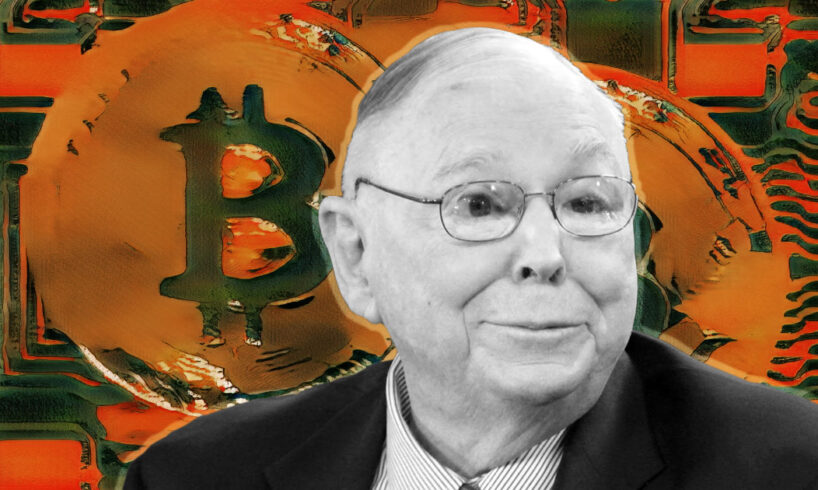

Charlie Munger has made it no secret that he is no fan of crypto.

The Berkshire Hathaway Vice Chairman said during a Daily Journal annual shareholder meeting on Feb. 15, that he was ashamed the US government has so far taken such a lenient approach at regulating it, preferring an all-out ban instead.

Munger said those who believe in crypto are “idiots,” adding that he sees no inherent value in the asset while adding that traditional currencies, on the other hand, have helped man evolve “from a successful ape to a [successful] human.”

“It [crypto] isn’t even slightly stupid, it’s massively stupid, and of course it’s very dangerous; the governments were totally wrong to permit it. And of course, I am not proud of my country for allowing this crap — well, I call it crypto shit. It’s worthless, it’s crazy, it’s not good, it’ll do nothing but harm, and it’s antisocial to allow it.”

Munder added that he does not see any rational argument for why a cryptocurrency must exist. “I don’t think there is a rational argument against my position,” Munger said.

On the presence of government in money, Munger said that currencies and countries go hand in hand.

“You oughta be able to state many issues: how big should the social safety net be? That’s a place where reasonable minds can disagree, and you should be able to state the case on the other side about it as well as the case you believe in,” Munger said.

“But when you’re dealing with something as awful as crypto shit, it’s just unspeakable,” he added. “I’m ashamed of my country that so many people believe in this kind of crap and the government allows it to exist.”

His comments echo numerous other statements he has given over the years, including calling crypto a “venereal disease” and Bitcoin as “probably rat poison squared.”

Comments that have only intensified after the collapse of FTX, once one of the world’s largest crypto exchanges.

Together with investor Warren Buffet, the two Berkshire Hathaway leaders have expressed their utter discontent over crypto several times. Their company focuses on a diverse range of holdings that include investments in sectors like insurance, retail, energy, finance, transportation, and manufacturing, and others. Between Munger and Buffet, the two have honed a highly successful investment thesis predicated on identifying distressed companies with long-term growth potential. Berkshire Hathaway has a current market capitalization of over $500 billion.

As of Feb 16., the total market capitalization of cryptocurrencies was approximately $1.07 trillion, down from the peak of over $2.7 trillion seen in November 2021.

However, in 2023, Bitcoin and Ethereum have experienced a significant rebound, along with other cryptos, increasing by approximately 40% and 35%, respectively, year-to-date.